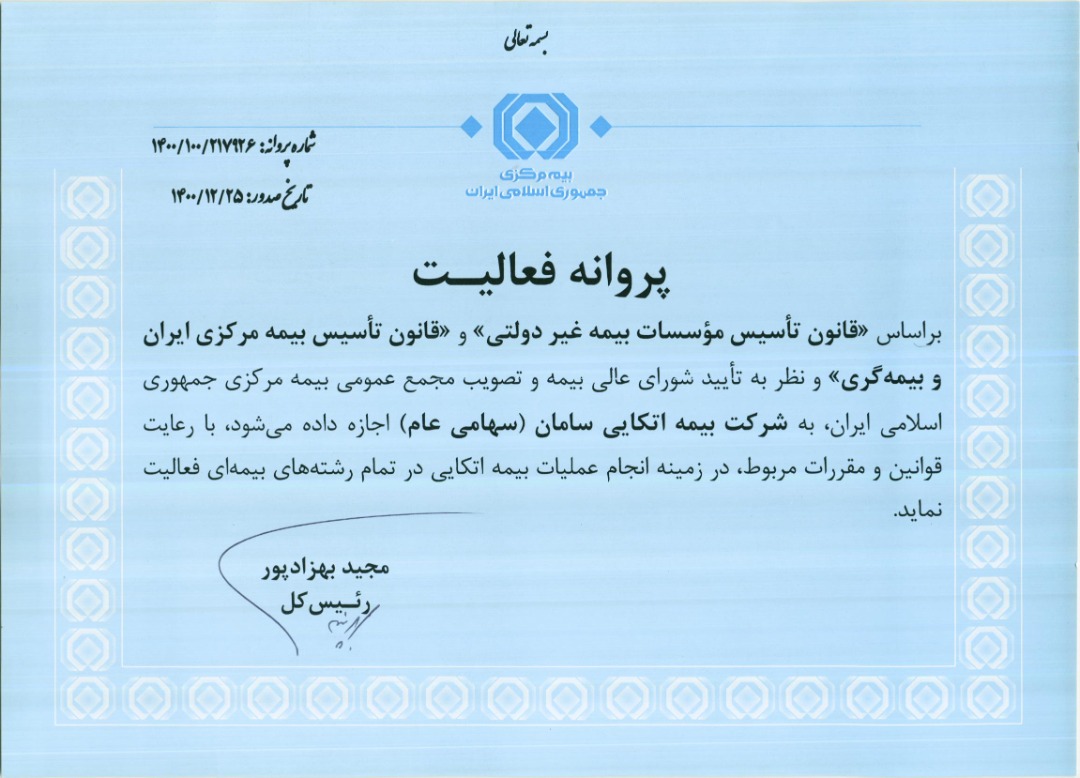

According to the Public Relations report of Saman Reinsurance Company, based on the “Law on Establishment of Non-Governmental Insurance Institutions,” and “Law on Establishment of Central Insurance of the Islamic Republic of Iran and Insurance,” and in consideration of the approval by the High Council of Insurance and the ratification by the General Assembly of the Central Insurance of the Islamic Republic of Iran, a license for the operation of Saman Reinsurance Company in the field of reinsurance operations across all insurance branches has been issued.

Mr. Rahim Mosaddegh, Deputy Director of Planning and Development at the Central Insurance of the Islamic Republic of Iran, in a letter to Ms. Mina Sadigh Noohi, CEO of Saman Reinsurance Company, congratulated the issuance of the company’s license and added: “It is expected that all officials of the company exert their efforts and precision in complying with relevant laws and regulations. In this regard, the Central Insurance of the Islamic Republic of Iran will supervise the company’s performance within the framework of relevant laws and regulations, in accordance with its legal responsibilities.”

He also emphasized compliance and full implementation of the following by Saman Reinsurance Company:

- All employees of the company, especially key qualified personnel for various positions, must operate within the approved regulations and provisions of the High Council of Insurance. In the event of any change in key personnel for any reason, it is necessary to introduce another qualified individual, meeting professional qualification requirements, to the Central Insurance beforehand.

- All necessary information, documents, and records required by various units of the Central Insurance must be submitted to this organization within the specified framework, in accordance with the approved regulations of the High Council of Insurance, directives, and circulars of the Central Insurance.

- In risk acceptance and retention, compliance with the regulations approved by the High Council of Insurance regarding the maximum allowable capacity of the company’s retention, as well as the requirements outlined in the regulation “Method of Calculating and Monitoring Financial Capacity of Insurance Institutions” and its operational plan, must be observed.

- Compliance with all provisions outlined in the company’s articles of association, which have been approved by the Central Insurance, and adherence to all obligations stipulated in the Anti-Money Laundering Law, its executive regulations, and directives is mandatory.