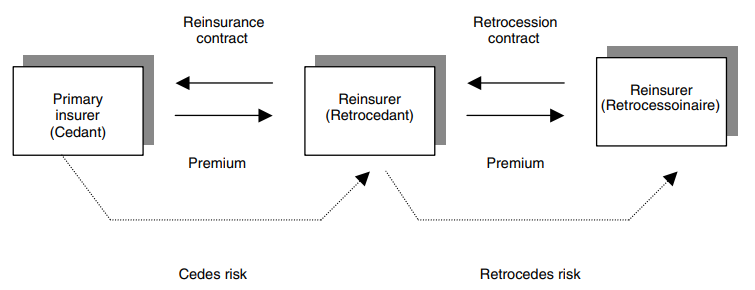

The mechanism of risk transfer through reinsurance and retrocession is illustrated in the following diagram:

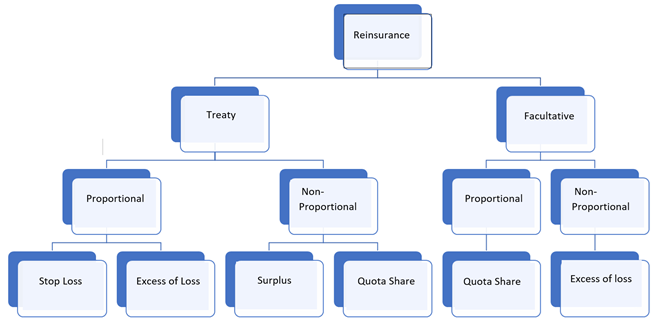

Different Types of Reinsurance

Facultative

Facultative reinsurance is a flexible arrangement where each insurance policy or risk is individually negotiated between the primary insurer and the reinsurer. It provides the option for insurers to choose which specific risks they want to cede, and reinsurers can decide whether to accept or decline each risk. This approach is used for unique or high-value risks that may not fit standard insurance policies.

Proportional (Quota Share)

Quota share facultative reinsurance is a specific type of facultative reinsurance arrangement where the primary insurer (ceding company) and the reinsurer agree to share the risk of a particular insurance policy based on a predetermined percentage or quota. In this arrangement, the ceding company retains a portion of the risk, and the reinsurer assumes the remaining portion up to the agreed-upon quota.

Non-Proportional (Excess of Loss)

Non-Proportional Facultative Reinsurance, often referred to as “Excess of Loss” reinsurance, is a specific type of facultative reinsurance arrangement. In this structure, the reinsurer agrees to cover losses that exceed a predetermined amount or “attachment point.” Unlike proportional reinsurance, where the reinsurer shares a proportional part of each risk, non-proportional reinsurance comes into play only when losses surpass a predefined threshold.

Treaty

Reinsurance treaties are agreements or contracts between an insurance company (the ceding company) and a reinsurer. These agreements establish the terms and conditions under which the reinsurer agrees to assume a portion of the risks underwritten by the insurance company. Unlike facultative reinsurance, which is negotiated on a case-by-case basis, reinsurance treaties provide coverage for a specific category or portfolio of risks.

Proportional (Quota Share)

A proportional quota share treaty is a type of reinsurance agreement in which the ceding insurance company and the reinsurer agree to share a predetermined percentage of each insurance policy underwritten by the primary insurer. In this arrangement, both the ceding company and the reinsurer participate proportionally in both the premium and losses associated with the covered risks.

Proportional (Surplus)

A surplus treaty in reinsurance is an agreement where the reinsurer covers a specified amount of risk that exceeds the ceding insurer’s retention level. Unlike proportional treaties, which involve a fixed percentage of each policy, surplus treaties focus on excess amounts above a predetermined threshold. In a surplus treaty, the ceding insurer retains a predetermined portion of each risk, and the reinsurer assumes responsibility for covering losses that surpass this retention level. This arrangement allows the primary insurer to maintain flexibility and control over a certain level of risk while transferring the excess risk to the reinsurer. Surplus treaties are often utilized for high-value or less predictable risks where the ceding insurer seeks additional protection beyond its retention capacity.

Non-Proportional (Excess of loss)

Excess of loss reinsurance treaties are risk-sharing agreements between insurance companies and reinsurers designed to protect the ceding insurer against large and catastrophic losses. In these arrangements, the ceding insurer sets a retention amount, or attachment point, which represents the threshold of losses it is willing to retain on its own. The reinsurer then covers losses exceeding this retention, up to a specified limit or reinsurance cap. Excess of loss treaties often consist of multiple layers, with each layer providing additional coverage for losses beyond the previous one. These agreements allow insurance companies to manage their exposure to severe risks and limit potential financial impacts, providing a crucial mechanism for stabilizing the industry in the face of unforeseen and substantial claims.

Non-Proportional (Stop Loss)

Stop loss reinsurance treaties are risk-sharing agreements between insurers (ceding insurers) and reinsurers where the reinsurer agrees to cover all losses exceeding a predetermined aggregate amount during a specific period, often a policy year. In this arrangement, there is a single attachment point, beyond which the reinsurer assumes responsibility for covering the remaining losses, up to a maximum limit. This type of reinsurance provides a straightforward mechanism for ceding insurers to limit their exposure to cumulative losses over a defined period.

The key difference between stop loss and excess of loss reinsurance lies in their structures. Unlike stop loss, excess of loss reinsurance involves layering, with multiple thresholds and retentions for different layers of coverage.